In an increasingly complex world where personal and business transactions often intertwine, the clarity of an agreement can be the bedrock of trust and successful relationships. Whether you’re lending money to a friend, documenting a business advance, or formalizing a short-term loan, a simple verbal agreement, no matter how well-intentioned, often falls short when misunderstandings or memory lapses inevitably arise. This is where the power of a written record, specifically an IOU letter, becomes indispensable.

An IOU, short for "I Owe You," is a straightforward yet legally significant document acknowledging a debt between two parties. It serves as a clear, undeniable record of what is owed, by whom, to whom, and under what conditions. For anyone navigating financial exchanges – from individuals lending a helping hand to small businesses extending credit – understanding and utilizing an effective iou letter template can prevent disputes, safeguard relationships, and provide peace of mind.

The Indispensable Value of Documented Agreements

In today’s fast-paced environment, the importance of clear, written communication cannot be overstated, especially when financial commitments are involved. A meticulously crafted IOU letter transcends the informality of a handshake, transforming a verbal promise into a tangible record. This documentation is not merely a formality; it’s a vital tool for safeguarding interests and maintaining transparency between all parties.

A well-composed agreement minimizes ambiguity, ensuring that both the lender and the borrower have a unified understanding of the terms. This proactive approach helps to avert future disputes, which can be costly in terms of both finances and strained relationships. In an age where digital correspondence can be fleeting, a properly documented IOU provides a solid reference point, accessible whenever questions arise.

Leveraging a Structured Document for Clarity

The advantages of starting with a ready-made iou letter template are numerous and compelling. Rather than drafting a document from scratch, which can be daunting and prone to omissions, a template provides a professional framework that guides you through the essential components of a robust agreement. This ensures consistency and completeness, critical factors in any financial arrangement.

Using a pre-designed structure eliminates the guesswork, helping you to include all necessary legal and financial details that might otherwise be overlooked. It also saves considerable time, allowing you to focus on the specifics of your unique situation rather than the basic layout. For individuals and businesses alike, this efficiency translates into greater confidence and reduced risk in their transactions.

Adapting Your Acknowledgment of Debt

While the core purpose of an IOU remains consistent—to acknowledge a debt—the specific circumstances surrounding that debt can vary significantly. A versatile iou letter template can be customized to suit a wide array of situations, making it a highly adaptable tool for managing diverse financial obligations.

Consider, for instance, a personal loan between family members. The template can be adjusted to reflect lenient repayment terms, perhaps without interest, while still formalizing the understanding. For a business extending a short-term advance to an employee, the document can be tailored to specify payroll deductions and a clear repayment schedule. Similarly, if the debt involves goods or services rather than direct currency, the template allows for a clear description of the items or work owed, their value, and the agreed-upon method of settlement. This personalization ensures the document accurately reflects the unique terms and conditions of each specific agreement, preventing generalities that could lead to future misinterpretations.

Essential Components of an Effective IOU

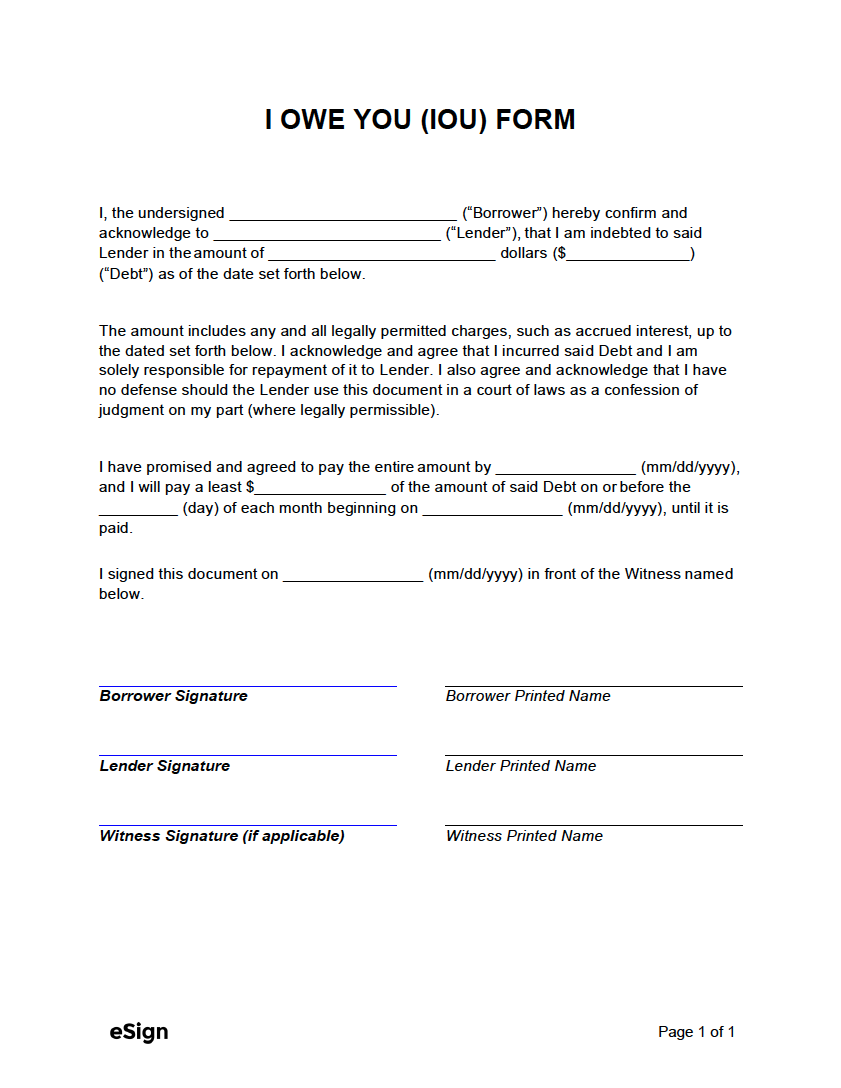

Every robust acknowledgment of debt should contain specific information to ensure its clarity and enforceability. Skipping any of these key elements could weaken the document’s validity and lead to complications down the line. A comprehensive iou letter template will guide you through including each of these vital parts:

- Identification of Parties: Clearly state the full legal names, addresses, and contact information of both the borrower (debtor) and the lender (creditor).

- Date of Agreement: Include the exact date the IOU is written and agreed upon.

- Amount of Debt: Explicitly state the total amount of money owed, both in numerical and written form, to avoid any confusion. If the debt involves goods or services, provide a detailed description and estimated monetary value.

- Purpose of Debt (Optional but Recommended): Briefly explain the reason for the debt (e.g., "for a down payment on a vehicle," "as a short-term business loan").

- Repayment Terms: This is crucial. Detail how and when the debt will be repaid. This includes:

- Due Date: A specific date by which the entire debt must be settled.

- Installment Schedule: If applicable, specify the amount of each payment, the frequency (e.g., weekly, monthly), and the dates payments are due.

- Method of Payment: How will payments be made (e.g., cash, bank transfer, check)?

- Interest Rate (If Applicable): If interest is being charged, state the annual percentage rate (APR) and how it will be calculated. Clearly define if interest accrues from the start or after a certain period.

- Late Payment Penalties (If Applicable): Outline any fees or additional interest that will be applied if payments are not made on time.

- Collateral (If Applicable): If the loan is secured, describe the asset being used as collateral.

- Governing Law: State which state’s laws will govern the agreement, especially important for inter-state transactions.

- Signatures: Both the borrower and the lender must sign and date the document. It is highly recommended to have the signatures witnessed by an impartial third party or notarized for added legal weight, especially for larger sums.

- Copies: Ensure both parties receive a signed copy of the final document for their records.

Crafting Your Message with Precision and Polish

Beyond the content, the presentation and tone of your IOU letter significantly impact its professionalism and effectiveness. When dealing with financial matters, clarity and a respectful yet firm tone are paramount, ensuring the seriousness of the agreement is conveyed without alienating the recipient.

For tone, aim for directness and objectivity. Avoid overly emotional language, even if the agreement is with a close friend or family member. The document should state facts and terms unambiguously. Regarding formatting, ensure a clean, professional layout. Use legible fonts (e.g., Arial, Calibri, Times New Roman), appropriate font sizes, and ample white space to enhance readability. Headings and bullet points, as demonstrated here, can help break up text and highlight crucial information.

When it comes to presentation, consider both digital and printable versions. For digital correspondence, a PDF format is generally preferred as it preserves the layout and prevents unauthorized edits. If a printable version is required, use quality paper and ensure all signatures are original. Always retain a copy for your records and send the original to the other party, or ensure both parties sign identical originals. This attention to detail reinforces the document’s validity and your professionalism.

In today’s interconnected business world, clear communication is the bedrock of strong relationships and successful transactions. The intelligent use of an iou letter template serves not just as a formality but as a strategic tool for managing expectations, preventing misunderstandings, and fostering trust. By leveraging a structured and well-thought-out document, you ensure that financial agreements are not left to chance or memory, but are instead firmly rooted in clarity and mutual understanding.

Ultimately, whether you are extending a loan or acknowledging a debt, the simple act of using a comprehensive iou letter template provides an efficient, polished, and time-saving method for formalizing commitments. It transforms potentially ambiguous verbal promises into concrete, actionable records, offering peace of mind and protecting the interests of all parties involved. Embrace this powerful communication tool to elevate your financial dealings to a new standard of professionalism and clarity.