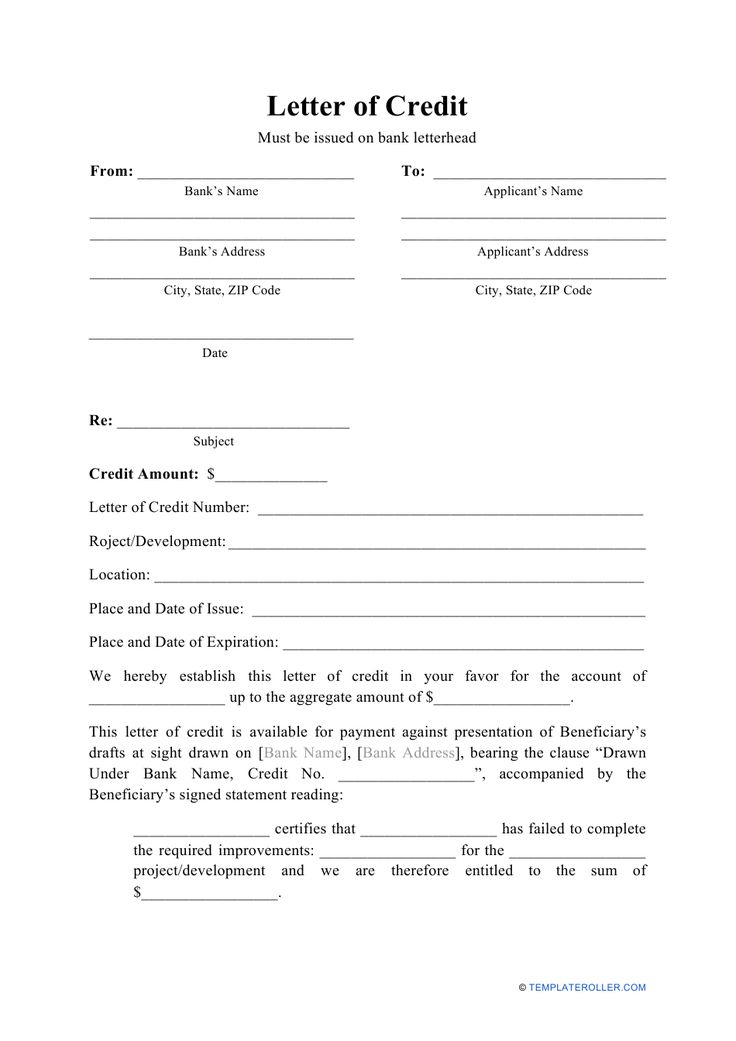

In the intricate world of global commerce, certain documents stand as pillars of trust and financial security. Among these, the Letter of Credit (LC) plays a crucial role, guaranteeing payment from a buyer to a seller. Crafting such a document demands absolute precision, adherence to international standards, and an unwavering eye for detail. Any misstep can lead to significant delays, financial losses, or even fractured business relationships. It’s a testament to the complexity of international trade that seemingly minor errors can have far-reaching consequences.

For businesses navigating these complex waters, particularly those in the US operating across borders, the value of a meticulously designed letter of credit draft template cannot be overstated. This isn’t just about saving time; it’s about embedding a standard of professionalism, reducing risk, and ensuring clarity in every transaction. Whether you are an importer, an exporter, a financial institution professional, or a business development manager, understanding and utilizing such a template is paramount for streamlined operations and secure dealings. It serves as your foundational blueprint for a critical financial instrument, ensuring every necessary clause and condition is accounted for, allowing you to focus on the unique aspects of each deal rather than reinventing the wheel with every new correspondence.

The Imperative of Polished Correspondence

In today’s fast-paced business environment, communication is not just about conveying information; it’s about conveying competence and credibility. A well-written, properly formatted letter reflects an organization’s professionalism and attention to detail. This is especially true for documents that carry significant legal and financial weight, such as an official financial instrument. The way a message is presented directly impacts how the recipient perceives the sender.

Poorly structured or error-ridden correspondence can erode trust, create confusion, and even lead to costly misunderstandings. When dealing with international trade finance, where multiple parties across different jurisdictions are involved, clarity is not just a preference—it’s a necessity. A polished document ensures that all parties are on the same page, minimizing ambiguity and facilitating smoother transactions. It underscores the sender’s commitment to accuracy and industry best practices.

Unlocking Efficiency with Pre-Designed Structures

The primary benefit of using a ready-made letter template, particularly for specialized documents like a letter of credit draft template, is the remarkable gain in efficiency and reduction in error. Instead of starting from scratch each time, which is both time-consuming and prone to oversight, a template provides a robust framework that covers all essential elements. This allows teams to allocate their valuable time to reviewing the specific, variable terms of a deal rather than constructing the fundamental document structure.

Beyond mere time-saving, templates act as a quality control mechanism. They ensure consistency in branding, tone, and legal boilerplate across all outgoing correspondence. For complex documents, this means critical clauses, banking details, and compliance language are consistently included and correctly positioned. This reduces the cognitive load on the sender and boosts confidence in the accuracy and completeness of the final document, translating to less back-and-forth and quicker approvals.

Tailoring Your Message for Every Occasion

While the core structure of a template provides stability, its true power lies in its adaptability. A robust template can be customized for a myriad of purposes and specific situations, demonstrating its versatility beyond a single use case. For example, while a letter of credit draft template offers a precise structure for financial guarantees, the principles of templating apply to many other forms of business correspondence.

Consider how a general professional letter template can be adapted. It might be personalized for job applications, where specific skills and experiences are highlighted. For formal requests, the template ensures all necessary information—what is being requested, why, and by when—is clearly articulated. In the case of recommendations, it provides a structured way to laud an individual’s merits. Even for formal notices, such as policy changes or important announcements, a template ensures consistent messaging and includes all legally required disclaimers. The ability to personalize specific sections while retaining a professional base makes templates indispensable for diverse communication needs.

Anatomy of an Effective Business Document

Every impactful business letter, regardless of its specific purpose, shares common foundational elements that ensure clarity, professionalism, and legal integrity. Understanding these key parts is crucial for anyone customizing or creating a template.

- Sender’s Information: This includes the full legal name of the sending entity, its address, and contact details. This establishes who the correspondence is coming from.

- Date: Crucial for record-keeping and establishing the timeline of communication. Always use a clear, consistent format.

- Recipient’s Information: The full legal name of the receiving entity or individual, their title, and their complete address. Accuracy here is paramount.

- Salutation: A professional greeting tailored to the recipient, often "Dear Mr./Ms. [Last Name]" or "To Whom It May Concern" for general notices.

- Subject Line: A concise phrase that immediately informs the recipient about the letter’s purpose, aiding in quick understanding and efficient filing. For a letter of credit, this would clearly state its nature and reference numbers.

- Opening Paragraph: Briefly states the main purpose of the letter. It should be clear and direct, setting the stage for the rest of the message.

- Body Paragraphs: These sections elaborate on the purpose, providing necessary details, explanations, supporting arguments, or conditions. Use clear, concise language and logical flow. For complex documents, break down information into digestible paragraphs or even bullet points for readability.

- Call to Action / Next Steps (if applicable): Clearly states what action is expected from the recipient or outlines the next steps in the process.

- Closing Paragraph: Summarizes the main point, reiterates gratitude, or expresses anticipation for the next phase.

- Complimentary Close: A polite closing phrase such as "Sincerely," "Regards," or "Best regards."

- Signature: A physical or digital signature of the authorized sender.

- Typed Name and Title of Sender: Below the signature, for clarity and official record.

- Enclosures/Attachments (if applicable): A notation indicating any additional documents or files that accompany the letter.

Mastering Presentation: Tone, Layout, and Delivery

Beyond the content itself, how a letter is presented significantly impacts its effectiveness. Tone, formatting, and the mode of presentation (digital or printable) all contribute to the recipient’s overall impression and the document’s professional integrity. A consistent, professional approach ensures your message is taken seriously.

Tone: The tone should always be professional, clear, and respectful. For formal documents like a financial guarantee, it must be precise and unambiguous, devoid of jargon where possible, or clearly defining any industry-specific terms. Avoid overly casual language, emotional appeals, or aggressive phrasing. A balanced, objective tone builds trust and facilitates understanding.

Formatting and Layout: A clean, organized layout enhances readability and professionalism.

- Standard Margins: Typically 1 inch on all sides.

- Font Choice: Use professional, legible fonts like Arial, Calibri, or Times New Roman, usually in 10-12 point size.

- Spacing: Single-space within paragraphs, with double-spacing between paragraphs and after key sections (e.g., date, address, salutation).

- Consistent Headings/Subheadings: If the letter is lengthy, use headings to break up text and guide the reader.

- Contact Information: Ensure all contact details for both sender and recipient are accurate and easy to find.

- Page Numbers: For multi-page documents, include page numbers.

Presentation (Digital vs. Printable):

- Digital Versions: When sending electronically, use PDF format to preserve formatting and prevent unauthorized alterations. Ensure that any embedded links are functional and attachments are clearly labeled. Consider using digital signatures for authenticity and legal validity.

- Printable Versions: For physical copies, use high-quality paper and a professional printer. Ensure all elements are aligned correctly and the print is clear. A professional letterhead enhances credibility. Always proofread the final printed version before dispatch to catch any last-minute errors.

In the complex landscape of modern business communication, particularly when dealing with critical instruments like a letter of credit, the utility of a well-crafted template extends far beyond mere convenience. It serves as a guardian of accuracy, a beacon of professionalism, and a powerful engine for efficiency. By leveraging a structured approach to your correspondence, you elevate your brand image, streamline your operations, and mitigate risks associated with human error.

Embracing the framework offered by a robust letter of credit draft template empowers businesses to focus on the strategic elements of their deals, confident that the foundational communication is precise and compliant. It’s an investment in clear, consistent, and credible communication that pays dividends in trust, efficiency, and ultimately, success in an increasingly interconnected global marketplace. By adopting such an efficient, polished, and time-saving communication tool, businesses ensure every message they send reinforces their commitment to excellence.