In the complex landscape of personal finance and credit management, effectively communicating with creditors can make a significant difference. One powerful tool in a consumer’s arsenal is the strategically crafted pay for delete letter. This specific type of correspondence is not just another piece of mail; it’s a negotiation instrument designed to improve your credit standing by offering to pay an outstanding debt in exchange for the removal of a negative entry from your credit report. Understanding its purpose and how to use it can be a game-changer for individuals and even small businesses looking to refine their financial reputation.

For anyone navigating the challenges of past financial missteps, or simply aiming to optimize their credit profile, a well-structured pay for delete letter template offers invaluable assistance. It streamlines a sensitive process, ensuring that your offer is presented professionally, clearly, and with the necessary legal precision. This approach significantly reduces the chances of misinterpretation and increases the likelihood of a successful negotiation. From individual consumers aiming to secure a mortgage to entrepreneurs needing better rates on business loans, the ability to effectively manage credit report entries through such a template can unlock significant financial opportunities.

The Imperative of Professional Correspondence in Credit Repair

In today’s digitally driven world, where much communication is informal and fleeting, the importance of a well-written, properly formatted letter often gets overlooked, especially in critical financial matters. When dealing with credit bureaus, creditors, or collection agencies, every word and every detail carries weight. A professional letter signals to the recipient that you are serious, informed, and organized. It establishes a respectful tone for negotiation, which can be crucial when discussing sensitive financial obligations and potential credit report adjustments.

Moreover, a formally structured letter provides a clear, documented record of your communication. This is vital in situations where disputes might arise or when you need to refer back to agreed-upon terms. Poorly written or informal messages can be easily dismissed, or worse, misinterpreted, leading to further complications rather than resolutions. In the context of credit repair, presenting a polished and precise document enhances your credibility and demonstrates your commitment to resolving the issue at hand.

Advantages of Utilizing a Pre-Designed Letter Framework

Crafting a compelling offer to resolve a negative credit entry can be daunting. This is where the main benefits of using a ready-made letter template become evident. Such a framework provides a solid foundation, ensuring all critical elements are included and presented in a logical flow. You won’t have to start from scratch, saving you considerable time and reducing the stress associated with drafting sensitive financial documents.

A template also acts as a safeguard, minimizing the risk of omitting vital information that could weaken your position or invalidate your offer. It typically includes placeholder text for all the necessary details, guiding you through the process of personalization. Furthermore, a pre-formatted structure ensures consistency in presentation, which contributes to an overall impression of professionalism and attention to detail. This consistency can be particularly valuable when sending multiple pieces of correspondence to different entities.

Adapting Your Offer for Specific Debt Scenarios

While the core purpose of a pay for delete letter remains consistent—offering payment for deletion—its application can be highly customized. The template serves as a robust base, but it must be tailored to the specifics of your situation. For instance, the amount you offer will vary based on the age of the debt, the original amount, and your current financial capacity. You might adjust the language slightly depending on whether you are negotiating with the original creditor or a third-party collection agency, as their operational procedures and willingness to negotiate can differ.

Customization extends to specifying the exact accounts you wish to address, including account numbers and original creditor details to avoid any ambiguity. You should also clearly state the exact negative entry or entries you expect to be removed from your credit reports (e.g., late payment, charge-off, collection account). The method and timing of payment also require careful consideration and clear articulation within your customized document. A well-adapted letter increases the chances of the recipient understanding and agreeing to your terms.

Essential Components of an Effective Pay-Off Letter

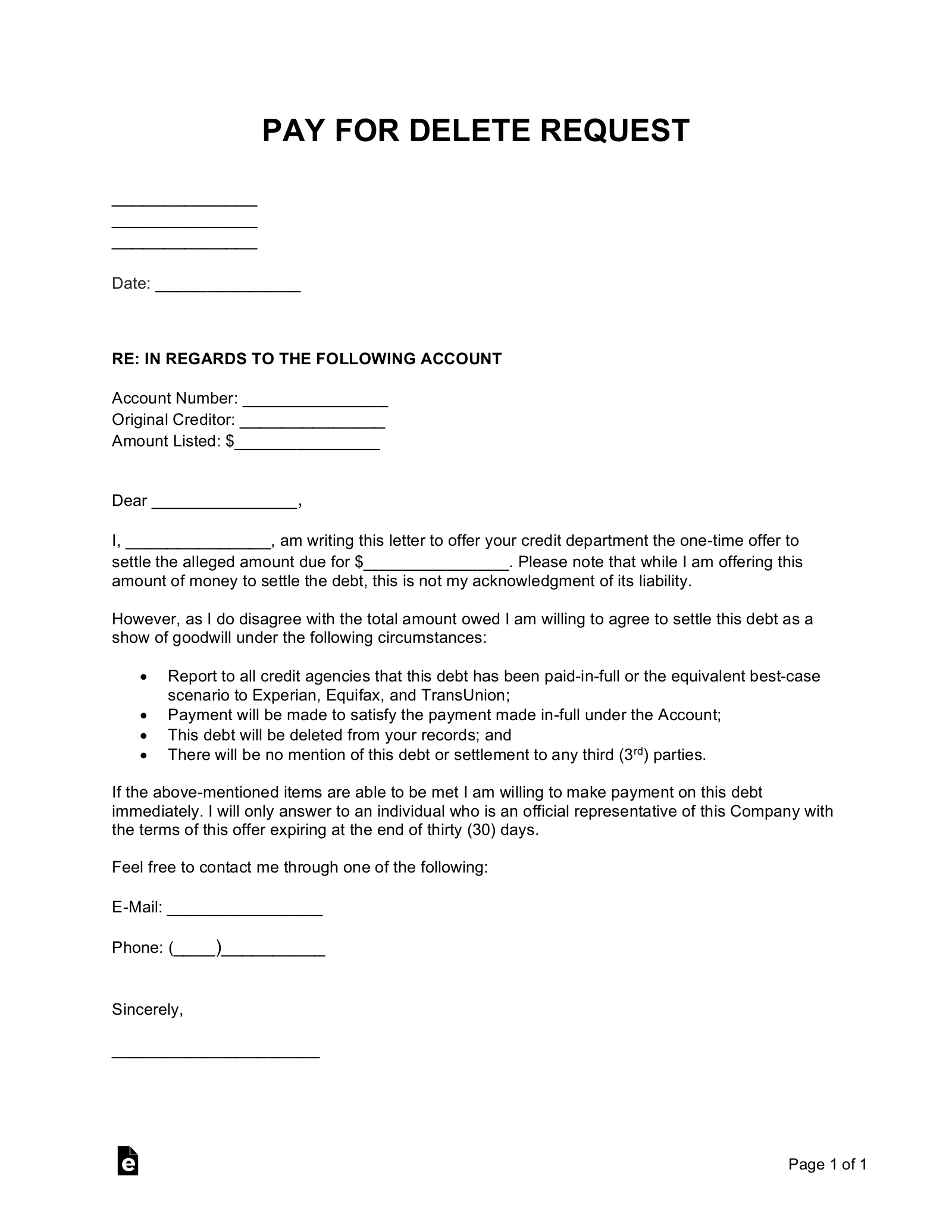

Every impactful piece of formal correspondence, especially one involving financial negotiation, relies on a clear, comprehensive structure. When preparing your offer, ensure it includes several key parts to be both persuasive and legally sound.

- Your Contact Information: Clearly state your full name, current address, phone number, and email.

- Recipient’s Contact Information: Provide the full name of the creditor or collection agency, their complete address, and, if known, the specific department or individual to whom the letter should be directed.

- Date: Crucial for establishing a timeline for the correspondence.

- Account Information: Detail the specific debt you are addressing, including the account number, original creditor, original amount, and current balance. This prevents any confusion about which debt is being discussed.

- Clear Statement of Intent: Explicitly state that this letter is an offer to pay a specific amount in exchange for the deletion of the associated negative entry from your credit reports.

- The Offer: Clearly state the exact payment amount you are offering and the proposed method of payment (e.g., cashier’s check, money order). Never send actual payment with the initial letter.

- Deletion Request: Explicitly state that upon receipt of payment, the creditor agrees to delete the negative entry (e.g., "charge-off," "late payment," "collection account") from all three major credit bureaus (Experian, Equifax, TransUnion).

- Time Limit for Response: Provide a reasonable deadline for their response (e.g., 10-15 business days) to encourage prompt action.

- Conditional Agreement: Emphasize that your offer is conditional upon their written agreement to delete the entry.

- Your Signature: A physical signature adds to the authenticity and formality of the document.

- Enclosures (if any): List any documents you are including, such as copies of relevant statements (though often not necessary in the initial outreach).

Crafting the Message: Tone, Presentation, and Format

Beyond the content, the way your pay for delete letter is presented significantly impacts its reception. The tone should be firm, professional, and respectful, yet assertive. Avoid emotional language, threats, or apologies. Your objective is to achieve a specific outcome, and a clear, business-like tone best facilitates that. Remember, you are entering a negotiation, and maintaining decorum is key.

When it comes to formatting, consistency and readability are paramount. Use a standard, easily readable font like Arial or Times New Roman in a size between 10 and 12 points. Ensure ample white space, proper paragraph breaks, and clear headings if applicable, though for this type of letter, a standard business letter format is usually sufficient. Proofread meticulously for any grammatical errors or typos, as these can detract from your professionalism.

For digital versions, if sending via email (though physical mail is often preferred for official debt negotiations due to its tangible record), convert your document to a PDF file. This preserves the layout and prevents any unauthorized modifications. For printable versions, use good quality paper and a reliable printer. Always retain a copy of the signed letter for your records, along with proof of mailing, such as certified mail with a return receipt requested. This meticulous approach to presentation ensures your critical correspondence makes the strongest possible impact.

When dealing with something as crucial as your credit report, having a reliable framework like a pay for delete letter template is not just a convenience—it’s a strategic asset. It demystifies the process of debt negotiation, empowering you to approach creditors with confidence and clarity. By utilizing a meticulously designed template, individuals and businesses can save valuable time and reduce the common anxieties associated with credit repair efforts.

Ultimately, a well-executed pay for delete letter template serves as a bridge to better financial health. It transforms a potentially overwhelming task into a manageable process, ensuring your communications are polished, precise, and professional. Investing the effort in customizing and sending a top-tier letter can lead directly to improved credit scores, opening doors to more favorable loan terms, lower interest rates, and a stronger overall financial foundation for the future.