In the intricate world of business and legal proceedings, clear, concise, and professional communication is not just a preference—it’s a necessity. From formal requests to critical notifications, the written word serves as a tangible record, an ambassador of your professionalism, and often, the first impression you make. Among the myriad documents that demand precision, a probate valuation letter template stands out as a particularly critical tool for anyone involved in estate administration, property assessment, or financial advisory roles. It’s a document that bridges the gap between complex financial data and legal requirements, ensuring all parties are on the same page regarding asset values post-mortem.

For executors, attorneys, real estate professionals, and even family members navigating the often-stressful process of settling an estate, the ability to generate accurate and legally sound valuation correspondence quickly can be invaluable. A well-structured probate valuation letter template streamlines what could otherwise be a time-consuming and error-prone task. It ensures that all necessary information, from asset identification to the methodology of valuation, is presented clearly and professionally, fostering trust and facilitating smoother probate proceedings for the benefit of all stakeholders.

The Enduring Significance of Professional Correspondence

Despite the rise of informal digital communication, the power of a well-crafted professional letter remains undiminished. In today’s fast-paced environment, where attention spans are short and information overload is common, a carefully structured letter cuts through the noise. It conveys authority, respect, and a commitment to detail that emails or instant messages often cannot. For critical matters like probate, legal documentation, or financial disclosures, the formality and permanence of a letter provide a level of credibility and legal weight that digital communication often lacks.

A physical or digitally signed formal letter ensures that your message is taken seriously by its recipient, whether that’s a court, a financial institution, or an inheritor. It reflects positively on the sender’s organization and attention to compliance. When dealing with sensitive financial information or legal obligations, the meticulous presentation of facts within a clear layout minimizes ambiguity and reduces the likelihood of misunderstandings or disputes, which can be particularly costly in estate matters. This emphasis on structured communication is paramount for maintaining professional integrity and clear record-keeping.

Unlocking Efficiency with a Structured Approach

The principal benefit of utilizing a ready-made letter template, particularly for specialized documents like a probate valuation letter template, lies in its capacity to dramatically enhance efficiency and consistency. Instead of drafting each letter from scratch, which can introduce inconsistencies and consume valuable time, a template provides a robust framework. This allows professionals to focus on the unique details of each case rather than the repetitive elements of document creation. It’s about working smarter, not harder, especially when managing multiple cases simultaneously.

Templates ensure that every essential piece of information is included, reducing the risk of oversight. They standardize the layout, tone, and professional appearance of all outgoing correspondence, reinforcing your brand’s image of reliability and thoroughness. Beyond mere time-saving, the consistency offered by a template instills confidence in recipients that they are receiving a professionally vetted document. This can be especially important in a business where trust and accuracy are paramount, providing a foundational level of quality control that is difficult to achieve otherwise.

Adapting Your Message for Diverse Audiences

One of the often-underestimated strengths of a versatile letter template is its inherent adaptability. While a specific probate valuation letter template serves a particular purpose, the underlying structure and principles of effective formal communication can be readily customized for a multitude of other situations. This flexibility makes a template a powerful tool in any business or communication professional’s arsenal, extending its utility far beyond its initial design brief. The core architecture—sender and recipient information, date, salutation, body, closing, and signature—is universally applicable.

Consider the application: a formal request for information might require specific bullet points detailing needed documents, while a letter of recommendation would emphasize positive attributes and examples. For formal notices, clarity of consequence and deadlines is crucial. Even within the context of probate, a template can be adjusted to value different types of assets (real estate, securities, personal property) or to address different stages of the probate process. The key is to understand which sections of the template are static and which are dynamic, allowing for strategic personalization that resonates with the specific recipient and purpose, ensuring that your communication remains impactful and relevant.

Deconstructing the Effective Letter

Regardless of its specific purpose, every professional letter, including a probate valuation letter template, is built upon several core components that ensure clarity, professionalism, and completeness. Understanding these key parts is essential for both using and customizing any template effectively.

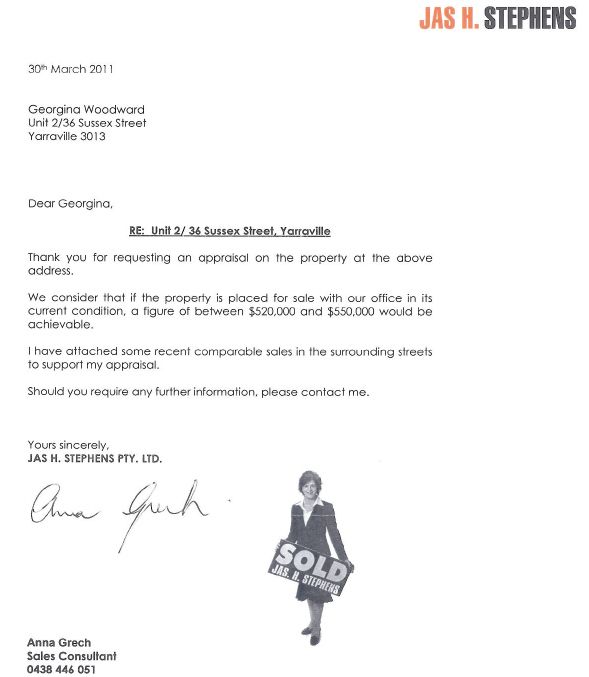

- Sender’s Contact Information: This includes the full name, organization name (if applicable), address, phone number, and email. It should be clearly placed at the top of the letter, usually on the left or centered.

- Date: The date the letter is written. Crucial for record-keeping and often a legal requirement.

- Recipient’s Contact Information: The full name, title, organization (if applicable), and address of the person or entity receiving the letter. Accuracy here is paramount.

- Salutation: A formal greeting, such as "Dear Mr./Ms. [Last Name]," or "To Whom It May Concern" if the specific recipient is unknown.

- Subject Line (Optional but Recommended): A concise phrase that summarizes the letter’s purpose, e.g., "Subject: Valuation of [Estate Name] Assets." This helps the recipient quickly grasp the letter’s content.

- Opening Paragraph: Briefly states the purpose of the letter and provides necessary context. For a probate valuation letter template, this would typically state that it’s a valuation report for a specific estate.

- Body Paragraphs: This is the core content where detailed information is presented. For a valuation, this would include:

- Identification of the assets being valued.

- The valuation date.

- The methodology used for valuation.

- The specific valuation figures for each asset.

- Any disclaimers or limiting conditions related to the valuation.

- Supporting evidence or references (e.g., appraisal reports, market data).

- Closing Paragraph: Summarizes the main points or outlines next steps. It often includes an offer for further clarification or assistance.

- Formal Closing: A professional sign-off, such as "Sincerely," "Regards," or "Respectfully."

- Signature: A handwritten signature above the typed name of the sender.

- Typed Name and Title: The sender’s full typed name and professional title.

- Enclosures (Optional): A note indicating any attached documents (e.g., "Enclosures: Appraisal Report, Market Analysis").

Each of these elements contributes to a comprehensive and legally sound document, ensuring that your message is fully understood and appropriately received.

Mastering Presentation: Digital and Print

Beyond the words themselves, the presentation of your correspondence significantly impacts its reception. The tone, formatting, and overall layout speak volumes about your professionalism and attention to detail. This holds true whether you are transmitting a digital document or a physical, printable version. Maintaining a consistent and polished appearance across all communication platforms reinforces your brand identity and enhances readability.

For tone, aim for clarity, objectivity, and respectful formality. In legal or financial contexts, avoid jargon where simpler terms suffice, but ensure technical accuracy when necessary. The objective is to inform, not to persuade with flowery language. Formatting is equally crucial: use a clean, professional font (e.g., Times New Roman, Arial, Calibri) in a readable size (10-12pt). Ensure adequate margins, consistent spacing between paragraphs, and appropriate line breaks. Use bolding or bullet points sparingly to highlight key information, but do not clutter the document. When creating a printable version, consider using quality paper and ensuring crisp print resolution. For digital delivery, a PDF format is generally preferred as it preserves the layout and prevents unintended alterations. Always proofread meticulously for any grammatical errors or typos, as even minor mistakes can detract from the credibility of your message.

In essence, whether your letter is destined for a physical mailbox or an email inbox, the goal is the same: to create a document that is not only informative but also effortlessly digestible and utterly professional. A polished presentation reinforces the gravity of the information contained within and shows due diligence on the part of the sender, particularly for critical documents like a probate valuation letter template.

Ultimately, in an era where effective communication is a competitive advantage, leveraging tools like a probate valuation letter template offers a clear pathway to enhanced professionalism and operational efficiency. It enables individuals and organizations to consistently deliver accurate, legally compliant, and impeccably presented information. This not only streamlines complex processes such as estate administration but also reinforces a reputation for meticulousness and reliability, which are priceless assets in any business niche.

By embracing a structured approach to communication, you empower your team to navigate the demanding landscape of legal and financial correspondence with confidence. The consistency, clarity, and time-saving benefits derived from a well-designed probate valuation letter template translate directly into greater productivity and reduced administrative burdens, allowing professionals to dedicate more energy to strategic tasks rather than reinventing the wheel with every new valuation request.