Navigating the complexities of business transitions, whether it’s a partner’s departure, a shareholder’s exit, or a strategic acquisition, invariably requires precision and foresight. At the heart of these intricate processes lies the buyout agreement – a pivotal legal document that defines the terms under which ownership interests are transferred. Without a clear, comprehensive, and legally sound framework, what should be a straightforward transfer can quickly devolve into costly disputes, operational disruptions, and irreparable damage to professional relationships.

For business owners, partners, legal professionals, and anyone involved in the equity transfer process, understanding and utilizing a robust buyout agreement template is not merely a convenience; it’s an essential strategic asset. This foundational document provides the structure necessary to outline intentions, define obligations, and protect the interests of all parties involved, ensuring that the transition is as smooth and equitable as possible. It serves as a blueprint, guiding the entire process from initial negotiation to final execution, and mitigating risks that could otherwise undermine the stability and future of the enterprise.

The Imperative of Documented Buyout Terms in Today’s Business Climate

In an increasingly dynamic and often litigious business environment, relying on handshake deals or vague understandings for significant transactions is a perilous gamble. The landscape of corporate governance, investor relations, and regulatory compliance is more complex than ever before, demanding meticulous documentation for every critical step. A well-articulated, written agreement for a buyout isn’t just good practice; it’s a fundamental requirement for safeguarding business interests and maintaining professional integrity.

Informal agreements, while seemingly efficient in the short term, are breeding grounds for future conflict. Memories fade, interpretations diverge, and external circumstances shift, leading to disagreements that can tie up resources, damage reputations, and even lead to protracted legal battles. By committing all terms to writing, parties establish an undeniable record of their intentions and commitments, significantly reducing the potential for misunderstandings and providing a clear reference point should any dispute arise. Furthermore, proper documentation ensures compliance with legal statutes and contractual obligations, an increasingly vital aspect for businesses operating under stringent US commercial laws.

Key Advantages and Safeguards Offered by a Standardized Framework

The strategic value of employing a well-structured buyout agreement template extends far beyond merely documenting terms; it provides a suite of benefits and protections that are invaluable to all stakeholders. Firstly, it offers unparalleled clarity and consistency. A template ensures that no critical element is overlooked and that all essential clauses are included, promoting a standardized approach across different buyout scenarios. This consistency not only streamlines the negotiation process but also instills confidence in all parties that the transaction is being handled professionally and thoroughly.

Secondly, a standardized framework acts as a significant time and cost-saving mechanism. Developing a comprehensive agreement from scratch for each unique situation is an arduous and expensive endeavor, often requiring extensive legal hours. A template, however, provides a pre-vetted foundation, allowing parties to focus their resources on customizing specific details rather than drafting boilerplate language. This efficiency translates directly into reduced legal fees and faster transaction timelines. Moreover, the protective layers embedded within a robust template—such as clear valuation methodologies, defined payment schedules, and detailed dispute resolution mechanisms—act as crucial safeguards, minimizing financial exposure and preserving business continuity during times of transition.

Tailoring Your Agreement: Customization Across Diverse Scenarios

While a standardized framework provides an invaluable foundation, the true power of an effective buyout agreement template lies in its adaptability. Businesses and their specific circumstances are rarely identical, meaning a one-size-fits-all approach to legal documentation is often insufficient. A robust template is designed to be a starting point, offering a flexible structure that can be extensively customized to meet the unique demands of various industries, ownership structures, and buyout scenarios.

Consider the vast differences between a partner buying out another in a professional services firm, a minority shareholder exit from a tech startup, or a complex equity transfer in a manufacturing company. Each scenario presents distinct challenges regarding asset valuation, intellectual property rights, ongoing client relationships, and regulatory considerations. A flexible template allows for the insertion of industry-specific covenants, bespoke payment structures, and clauses that address particular operational concerns. For instance, a tech company might need specific provisions for software licenses or patent transfers, while a retail business might focus on inventory and lease agreements. Engaging legal counsel to tailor the template to precise circumstances ensures that the final document accurately reflects the parties’ intentions and fully complies with all applicable laws and regulations, transforming a generic form into a powerful, bespoke legal instrument.

Essential Components of a Comprehensive Buyout Contract

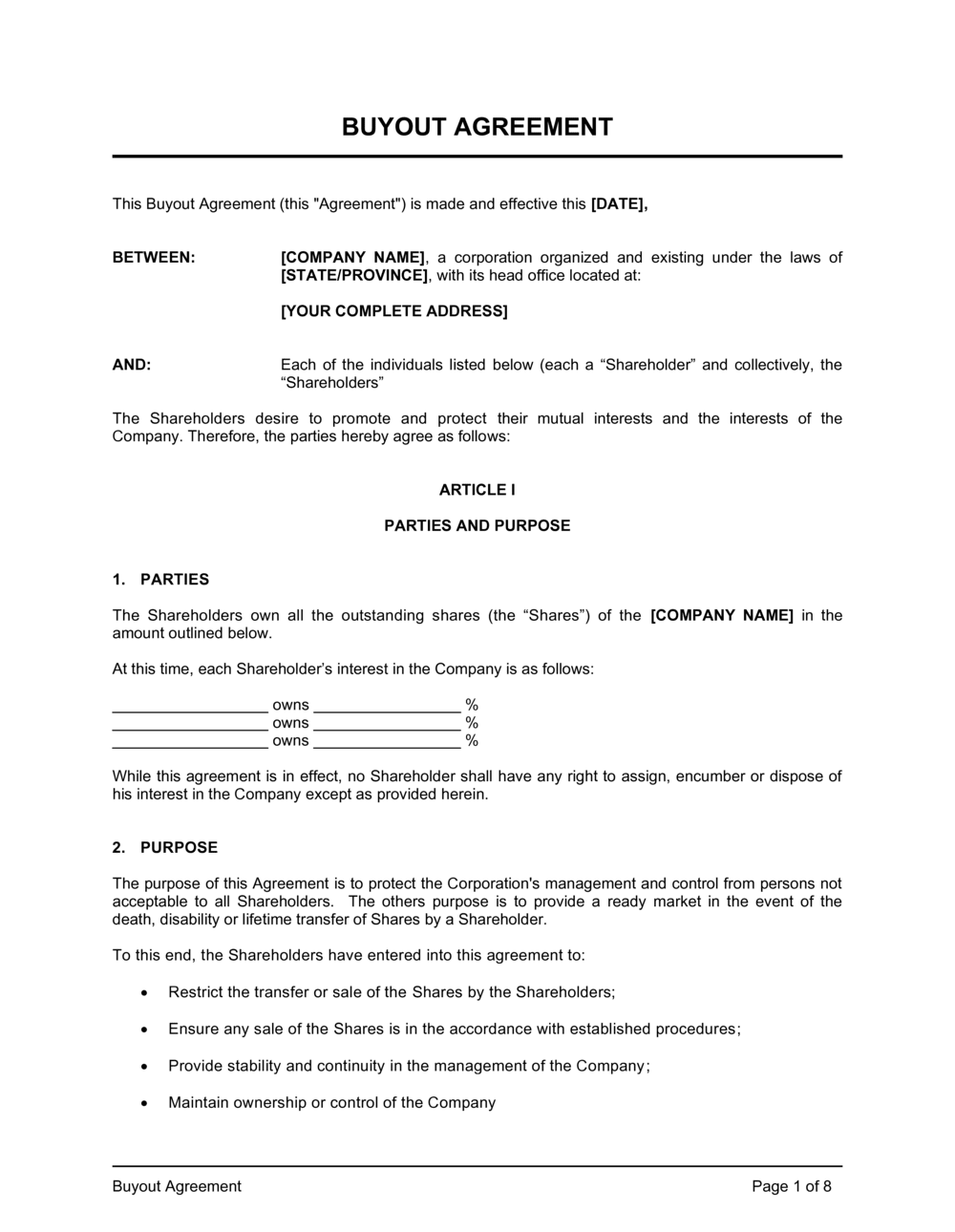

A well-drafted buyout agreement, whether generated from a template or crafted from scratch, must include certain fundamental clauses to be effective and legally sound. These provisions ensure clarity, protect all parties, and address potential contingencies. While the specific details will vary, the core elements remain consistent:

- Identification of Parties: Clearly states the full legal names and addresses of all individuals and entities involved in the buyout.

- Definitions: Provides clear definitions for key terms used throughout the agreement to prevent ambiguity.

- Purpose of Agreement: Articulates the intent behind the buyout, outlining what is being bought and sold (e.g., specific shares, partnership interest).

- Consideration and Payment Terms: Details the purchase price, how it was determined (valuation methodology), payment schedule, interest rates (if applicable), and any financing arrangements.

- Representations and Warranties: Statements of fact made by both the buyer and seller about the current state of the business, its assets, liabilities, and legal compliance.

- Covenants: Promises made by the parties to perform certain actions or refrain from others, both before and after the closing date (e.g., maintaining business operations, non-disclosure).

- Conditions Precedent to Closing: Specifies conditions that must be met by one or both parties before the transaction can be finalized (e.g., regulatory approvals, due diligence completion).

- Indemnification: Clauses outlining how one party will compensate the other for losses or damages incurred due to breaches of the agreement or specific pre-existing liabilities.

- Confidentiality: Provisions protecting sensitive business information from unauthorized disclosure.

- Non-Compete and Non-Solicitation (if applicable): Restrictions on the selling party from competing with the business or soliciting its employees/clients for a defined period after the buyout.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Dispute Resolution: Outlines the process for resolving disagreements, which might include mediation, arbitration, or litigation.

- Entire Agreement: A clause stating that the written document constitutes the complete and final agreement between the parties, superseding any prior discussions or understandings.

- Amendments: How the agreement can be modified in the future, typically requiring written consent from all parties.

- Notices: Specifies the method and address for all official communications between the parties.

- Signatures: Spaces for all parties to sign and date the agreement, often with witness or notary acknowledgment.

Enhancing Usability: Formatting and Readability for Modern Professionals

Even the most legally robust buyout agreement template can fall short if it’s poorly formatted or difficult to read. In the fast-paced world of business, professionals need documents that are not only comprehensive but also easily digestible, whether reviewed on a screen or in print. Thoughtful formatting and an emphasis on readability are crucial for ensuring the agreement is understood by all stakeholders, not just legal experts.

Practical tips for enhancing usability include employing clear and descriptive headings for each section, utilizing a logical flow that guides the reader through complex information, and incorporating ample white space to prevent the document from appearing overly dense. Consistent formatting—including font choices, paragraph spacing, and bullet points or numbered lists for enumeration—significantly improves visual appeal and comprehension. Furthermore, defining key terms early in the document or in a dedicated "Definitions" section ensures that technical jargon is universally understood. For complex financial schedules or asset lists, appending them as exhibits or schedules keeps the main body of the agreement concise while providing necessary detail. Prioritizing readability ensures that all parties can quickly locate relevant information, understand their obligations, and confidently proceed with the transaction.

In the complex landscape of business transitions, having a reliable and comprehensive buyout agreement template is not just a legal formality; it is a strategic necessity. It provides the clarity, structure, and legal safeguards required to navigate the often-sensitive process of transferring ownership interests, transforming potential conflict into a smooth, predictable process. By standardizing the essential framework while allowing for critical customization, such a template acts as a cornerstone for fair dealings and enduring business relationships.

Ultimately, leveraging a professional-grade buyout agreement template empowers businesses to approach significant ownership changes with confidence and precision. It ensures that all parties are protected, obligations are clearly defined, and the transaction complies with legal requirements, saving time, mitigating risks, and preserving value. In an environment where every detail matters, a well-utilized template becomes an indispensable tool for securing a successful and amicable transition, safeguarding the future of the enterprise for years to come.