In the intricate world of corporate governance and investment, situations often arise where the registered owner of shares differs from the true beneficial owner. This arrangement, commonly known as a nominee shareholder relationship, serves various strategic purposes, from upholding confidentiality and streamlining administrative processes to navigating complex regulatory landscapes or holding shares for minors. While seemingly straightforward, the absence of a clear, legally binding understanding between the parties can lead to significant complications, misunderstandings, and even protracted legal disputes down the line. This is where a robust nominee shareholder agreement template can be an invaluable asset for businesses, investors, and legal practitioners alike.

Such a template provides a structured foundation for defining the roles, responsibilities, and rights of both the nominee (the registered shareholder) and the beneficial owner (the true owner). It meticulously outlines the scope of authority, conditions for share transfer, and protections for all involved, ensuring that the beneficial owner’s interests are always paramount, despite the shares being held in another party’s name. For anyone engaging in or facilitating such arrangements, understanding and utilizing a comprehensive, customizable template is not merely a convenience but a critical risk management tool.

The Imperative of Documented Arrangements

In today’s fast-paced business environment, clarity and precision are non-negotiable, particularly concerning legal documentation. A handshake deal or a verbal understanding, no matter how well-intentioned, rarely stands up to scrutiny when disputes arise or external audits are conducted. This is especially true in the nuanced area of nominee shareholding, where the legal and beneficial ownership diverge.

A meticulously drafted agreement acts as an authoritative record, leaving no room for ambiguity regarding the intentions and obligations of each party. It serves as a blueprint for managing the relationship, ensuring compliance with corporate regulations, and providing a clear framework for decision-making related to the shares. Without such a document, both the nominee and the beneficial owner expose themselves to unnecessary risks, including potential allegations of fraud, unauthorized actions, or a loss of beneficial ownership rights.

Core Advantages of a Standardized Document

Leveraging a well-crafted nominee shareholder agreement template provides a multitude of benefits, extending beyond mere legal compliance. It offers a layer of protection that safeguards the interests of both the beneficial owner and the nominee, ensuring a smooth and transparent operation of the shareholding arrangement.

Firstly, it significantly reduces legal fees and time associated with drafting an agreement from scratch. Legal professionals can focus on tailoring specific clauses rather than building the entire document from the ground up. Secondly, a template ensures consistency and completeness, covering common scenarios and potential pitfalls that might otherwise be overlooked. This standardization helps maintain legal integrity across multiple similar arrangements a business might undertake.

Furthermore, it offers crucial protections. For the beneficial owner, the agreement explicitly states that despite the nominee holding the legal title, all rights, profits, and control ultimately rest with the beneficial owner. For the nominee, it clarifies that they are merely acting as a trustee, insulating them from personal liability for the underlying business risks associated with the shares. This clear delineation of roles and responsibilities fosters trust and transparency, which are essential for any successful business relationship.

Tailoring the Framework to Specific Needs

While a strong template provides a solid foundation, its true value lies in its adaptability. A standard nominee shareholder agreement template should be flexible enough to be customized for a wide array of industries, specific investment scenarios, and unique jurisdictional requirements within the United States. For instance, an agreement for shares in a tech startup might emphasize intellectual property rights and exit strategies differently than one for a real estate holding company, which might focus more on asset management and distribution of rental income.

Consider the context: is the nominee holding shares for a foreign investor, necessitating adherence to specific international tax treaties or reporting requirements? Is it for a minor, requiring detailed provisions for guardianship and maturity? Or is it for regulatory compliance, such as to meet local ownership requirements without disclosing the ultimate beneficial owner to the public? Each scenario demands careful customization of the template’s core clauses. This process often involves adjusting definitions, modifying clauses related to voting rights, outlining specific reporting obligations, and specifying the conditions under which the nominee must transfer the shares back to the beneficial owner or a third party.

Anatomy of an Effective Nominee Arrangement

Every comprehensive nominee shareholder agreement template should meticulously detail several essential clauses or sections to ensure it is robust, legally sound, and addresses all potential aspects of the relationship. These core components serve as the backbone of the agreement:

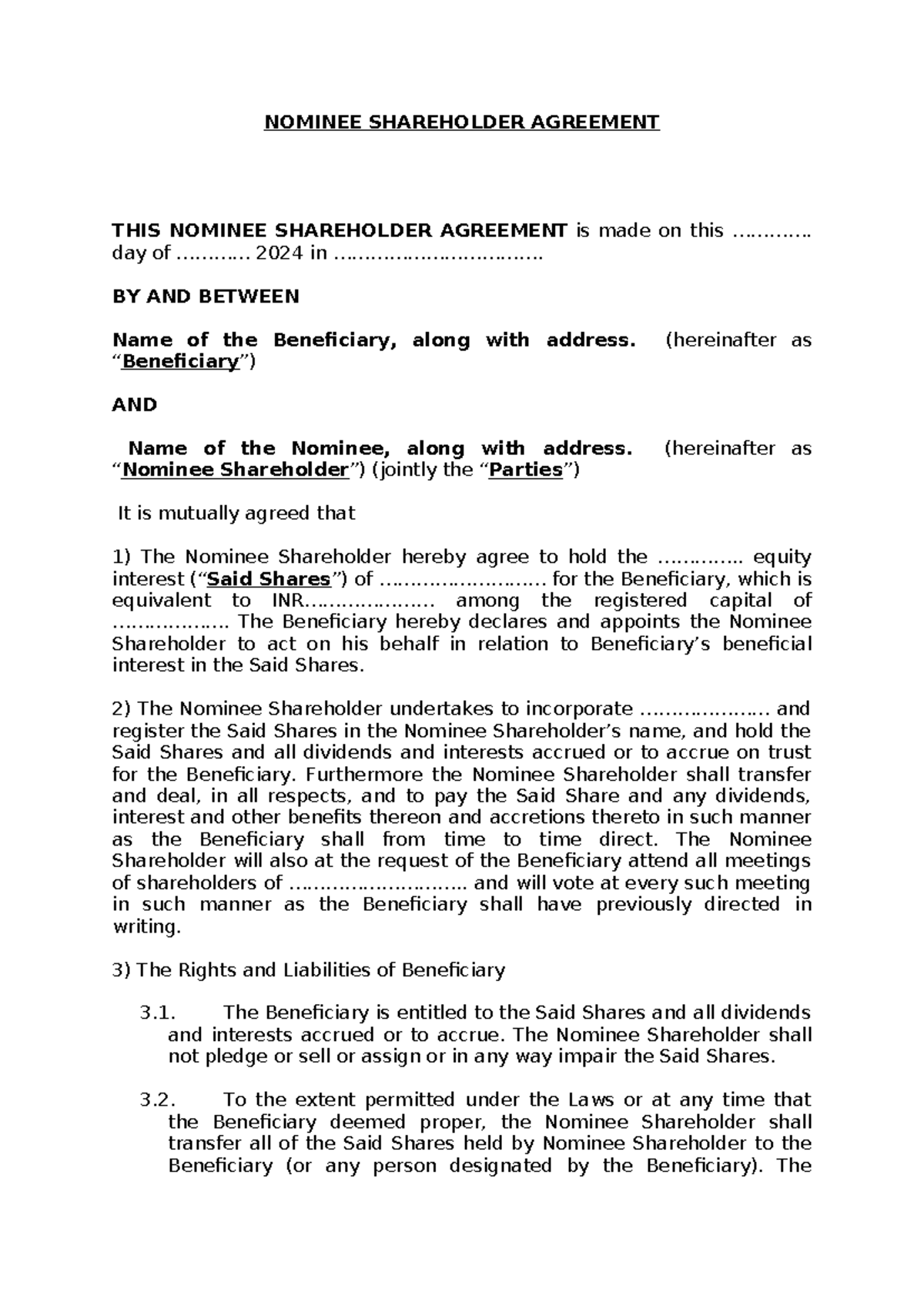

- Parties Identification: Clearly state the full legal names, addresses, and relevant identification numbers (e.g., EIN for companies, SSN for individuals) of both the nominee and the beneficial owner.

- Recitals/Background: Briefly explain the context and purpose of the agreement, setting the stage for the specific terms and conditions that follow.

- Appointment of Nominee: Explicitly state that the beneficial owner appoints the nominee to hold shares on their behalf, and the nominee accepts this appointment.

- Declaration of Trust: This is a crucial clause, affirming that the nominee holds the shares solely as a bare trustee for the beneficial owner and has no beneficial interest in the shares whatsoever.

- Share Details: Accurately describe the shares being held (e.g., number, class, par value, company name, certificate numbers if applicable).

- Nominee’s Obligations and Powers: Outline the nominee’s duties, such as attending shareholder meetings (if instructed), signing documents as directed, and not exercising any rights without the beneficial owner’s explicit consent.

- Beneficial Owner’s Rights and Indemnification: Clearly state that all rights, including voting, dividends, and capital distributions, belong to the beneficial owner. Include an indemnification clause where the beneficial owner agrees to indemnify the nominee against any liabilities or costs arising from their role as nominee.

- Instructions and Communications: Establish a clear protocol for how the beneficial owner will provide instructions to the nominee and how communications will be handled.

- Termination and Share Transfer: Specify the conditions under which the agreement can be terminated (e.g., by notice, upon sale of shares, upon an event), and detail the process for transferring the shares back to the beneficial owner or a third party.

- Confidentiality: Include provisions to protect sensitive information related to the agreement and the beneficial owner’s identity.

- Representations and Warranties: Both parties make certain guarantees, such as having the authority to enter the agreement.

- Governing Law and Jurisdiction: Specify which state or federal laws will govern the agreement and in which courts disputes will be resolved, typically within the United States.

- Costs and Expenses: Detail who bears the costs associated with the nominee arrangement (e.g., legal fees, administrative charges).

- Notices: Outline how formal notices between the parties must be delivered.

- Entire Agreement: A standard clause stating that the document constitutes the entire agreement between the parties, superseding all prior understandings.

Best Practices for Document Presentation

The utility of any legal document is significantly enhanced by its presentation. For a nominee shareholder agreement template, readability, clarity, and ease of use are paramount, whether it’s intended for print or digital consumption. Prioritize a logical flow of information, using clear headings and subheadings to guide the reader through complex clauses.

Employing short, concise paragraphs (typically 2-4 sentences) improves comprehension and reduces cognitive load. Bullet points, as demonstrated above, are excellent for enumerating lists of obligations, rights, or conditions, breaking up dense text and highlighting key information. Use a professional, easy-to-read font (like Arial, Calibri, or Times New Roman) with an appropriate size (10-12 points for body text). Ensure sufficient white space around text and between sections to prevent the document from appearing cluttered. For digital use, consider hyperlinking to definitions or related sections if the document is extensive. Finally, include clear signature blocks for all parties and witnesses, ensuring dates are properly recorded for full legal effect.

Ultimately, a thoughtfully utilized nominee shareholder agreement template serves as an indispensable tool in modern business and investment practices. It provides the legal rigor necessary to manage complex shareholding structures with confidence, significantly mitigating potential risks for both the nominee and the beneficial owner. By customizing a comprehensive template, businesses and individuals can ensure their unique needs are met while adhering to best practices in corporate governance.

The strategic deployment of a robust nominee shareholder agreement template not only saves valuable time and resources but also fosters clarity and trust among all parties involved. In a landscape where transparency and legal precision are highly valued, investing in a well-drafted and adaptable agreement is a testament to professional due diligence and foresight.